|

Have a large wall space that needs some décor but worried it will cost you hundreds of dollars in art? Not necessarily! Here are some ideas for filling a large wall without emptying your bank account.

0 Comments

If you are interested in buying new construction, know that the process differs somewhat from buying a pre-owned home. I can help you through the process!

1. Decide on Your Builder & Homesite. If you are looking at a particular neighborhood, find out if there is one builder or if the developer allows you to bring in your own builder. If you are looking at building on a lot that is not restricted to a particular builder, it’s important to research builders in your area to find one that is reputable and stands by their work. Meet with builders before you make your selection. It’s important that they are organized and communicate well. 2. Obtain Pre-approval or Proof of Funds. Builders or developments often work with particular mortgage companies and will offer discounts on closing costs for using their “preferred” lender. Whether you use the builder’s lender or someone else, you will need to get pre-approved for financing. If you are not financing, obtain proof of funds from your financial institution. 3. Sign a Contract with Your Builder. Builders use their own contracts that are similar to a regular sales contract, but include additional terms specific to the building process, such as at what points during building the contractor gets paid, and what options you have to choose from. Your agent can help you interpret the terms of the builder’s contract before you sign. 4. Secure a Loan. Once you sign your contract, the lender will need to get started on your loan application. It’s important that you provide them any information they ask for in a timely manner. 5. Select Your Options. There will be a lot of decisions to be made throughout your build. Being prepared with your choices at each stage will help keep the build on schedule. Most builders have someone who will work with you to let you know what stage they are on and which decisions are coming due and when they need to be made. If your build is custom, you will need to do a lot of research into finishes, fixtures, colors, hardware, and appliances so you know what you want and what you can afford. 6. Home Walk Throughs Throughout the Building Process. You will need to check on every phase of construction to double check that everything is done according to plan. Even the best builders have miscommunications, mix-ups on orders, or problems with installations. Plan on visiting the home daily once it gets dried-in. 7. Optional Inspection. Even though your home is brand-new, you might still want to have a home inspection done. Sometimes an inspector will catch something that slipped past the contractor and code enforcement. 8. Closing day! Closing day on new construction differs slightly from a pre-owned home in that there is often a “punch list” of items the builder is responsible for finishing up either on closing day or shortly afterwards. This may include cleaning, touch-up painting, installing landscaping, or changing out locks. You should have the opportunity to go through the house with the builder shortly before closing to add items you notice to the punch list. Summer is in full swing and with social distancing keeping us from frequenting restaurants as often as we might normally, picnicking is a great way to get your family outside for some meal-time adventure.

Here are some tips to make it extra fun for the whole family. • Instead of packing one large cooler that might be cumbersome to transport to your picnic spot, use smaller coolers for food and drinks, and totes for supplies. Let each family member be in charge of carrying one item so mom and dad don’t bear the brunt of the work. • Pack some playthings. Kids get bored fast, so bring games, balls, bubbles, or outdoor toys to give them more to do than just eat. • Keep everyone comfortable with sunscreen, insect repellent, hats, and sunglasses. Remember that as you play and eat throughout the afternoon and the sun goes down, you might need to switch from sunscreen to sunshades. You won’t want the fun to be forced to an early end due to an onslaught of mosquitoes, a bad sunburn, or the sun shining in everyone’s eyes. • Make your picnic spot more comfortable by bringing a small rake. A child-sized rake is easy to pack and will allow you to quickly clear your site of prickly pinecones, pebbles, or seashells. • A nice large picnic blanket is a great idea and makes for pretty pictures, but camp chairs and a small folding table are more comfortable and keep you away from the ants. • Make your outing educational. Even if you are only going to the backyard, you may be able to find some teaching moments among the trees, plants, insects, or critters that live nearby. If you are headed to a park, visit their website first and find out a little about the history of the area or the plants and animals in the area. For nighttime excursions, a location away from artificial light will make stargazing easy. Bring a strong flashlight to point out constellations. Thanking about selling your home but not sure if the fall is the right time of year? It’s actually a great time to put your home on the market. Here are some of the benefits of listing your home in the fall.

There is something about decorating for fall that gives me the warm fuzzies! It may be the promise of cool, crisp evenings with brilliant sunsets, or the fact that fall decorating is all about creating a cozy atmosphere in your home. The fun thing about fall decorating is that it’s easy and inexpensive. Here are a few of my favorite fall decorating ideas that are easy to accomplish on a shoestring budget.

Through all the volatility in the economy right now, some have put their search for a home on hold, yet others have not. According to ShowingTime, the real estate industry's leading showing management technology provider, buyers have started to reappear over the last several weeks. In the latest report, they revealed: “The March ShowingTime Showing Index® recorded the first nationwide drop in showing traffic in eight months as communities responded to COVID-19. Early April data show signs of an upswing, however.” Why would people be setting appointments to look at prospective homes when the process of purchasing a home has become more difficult with shelter-in-place orders throughout the country? Here are three reasons for this uptick in activity: 1. Some people need to move. Whether because of a death in the family, a new birth, divorce, financial hardship, or a job transfer, some families need to make a move as quickly as possible. 2. Real estate agents across the country have become very innovative, utilizing technology that allows purchasers to virtually:

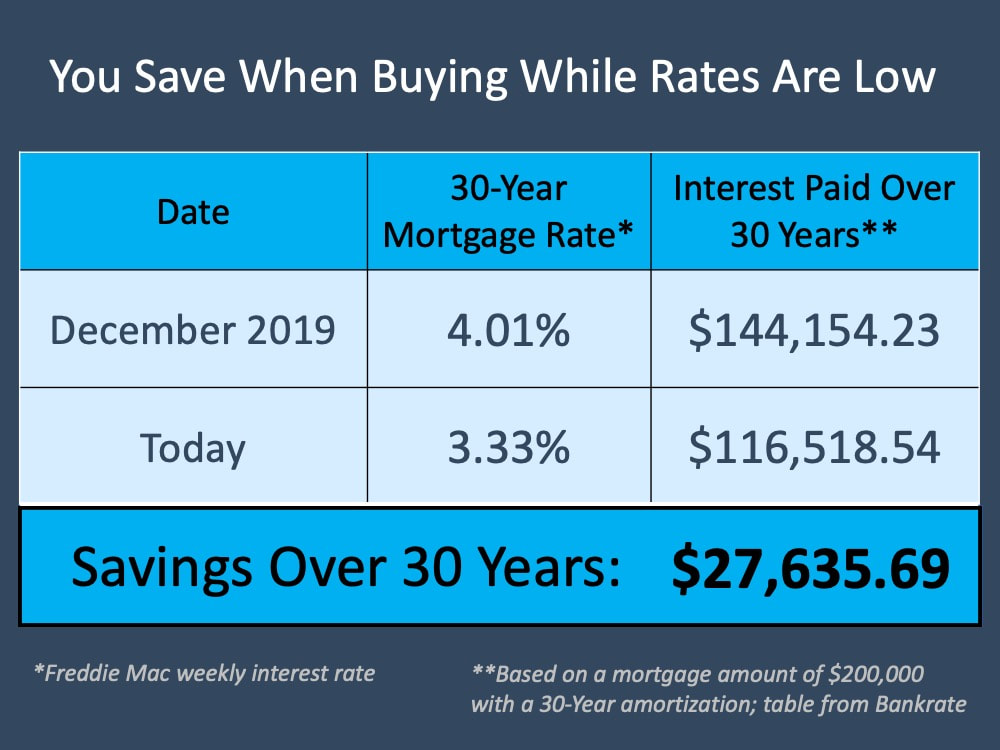

3. Buyers understand that mortgage rates are a key component when determining their monthly mortgage payments. Mortgage interest rates are very close to all-time lows and afford today’s purchaser the opportunity to save tens of thousands of dollars over the lifetime of the loan. Looking closely at the third reason, we can see that there’s a big difference between purchasing a house last December and purchasing one now (see chart below): Bottom LineMany families have decided not to postpone their plans to purchase a home, even in these difficult times. If you need to make a move, let’s connect today so you have a trusted advisor to safely and professionally guide you through the process.

Everyone knows someone it has happened to or has heard a tragic story. It could have been a fire, a flood, a burglary or some other disaster but to file a claim on their insurance, they need the receipts or a list for what is being claimed.

Since you're at home anyway and may even have kids at home who need something to do, now is a great time to get a current home inventory done. One of the easiest ways to accomplish this seemingly, daunting task is to put together a collection of pictures of every room in your home. The more valuable, the more important it is to take a close-up picture. It will be necessary to open the drawers and closets and, in some cases, to pull things out in order to show everything in the picture. That's why having someone to help you makes it faster and easier. Not to get distracted from the job at hand, you may discover things that you had forgotten you had which is why you should do an inventory rather than trying to reconstruct it after the loss. In some cases, it may be years after you've filed a claim when you remember you forgot some things. Having photos or videos of the different rooms in your house combined with a list of the items can serve as the proof you need for your claim. There are other benefits to doing a home inventory also. You'll know the "right" amount of insurance to have on your personal belongings by assigning replacement costs to them. It will simplify filing a claim if you ever need to. To organize your photos and even provide a detailed list of higher value items, you can download a Home Inventory in an interactive PDF that you can complete. You can put it together on your computer and store it online to make it available if the computer is stolen or damaged. |

The Ryan Whyte TeamGet to know everything about Arizona Real Estate. Archives

December 2020

All

|

RSS Feed

RSS Feed